Nevertheless, be careful here: Holding far too much funds in municipal bonds could basically power you to pay for taxes or to pay additional taxes when coupled with the earnings of your Social Security Advantages. So “tax-no cost” municipal bonds may well wind up costing you cash.

What's Investing? Investing, broadly, is Placing money to operate for any timeframe in the project or enterprise to generate optimistic returns (gains that exceed the level of the Original financial investment).

Investing in housing, by way of example, could necessarily mean acquiring a cheap assets, renovating to enhance its benefit, and after that selling or leasing for over the initial cost.

Wherever to get mutual money: Mutual resources can be obtained straight from the businesses that manage them, and also via price cut brokerage corporations. Almost all of the mutual fund providers we critique supply no-transaction-fee mutual cash (which suggests no commissions) along with tools to assist you choose resources.

Extended-term corporate bond money is usually fantastic for possibility-averse investors who want more produce than authorities bond money.

A certificate of deposit (CD) is usually a federally insured cost savings account that gives a hard and fast curiosity fee for an outlined length of time. Now may be a great the perfect time to lock in that mounted amount — in contrast to a personal savings account, CD fees would not fluctuate if desire costs go down in 2025 as envisioned.

Who're they great for? If you'd like to reach better returns than far more traditional banking merchandise or bonds, an excellent choice is definitely an S&P five hundred index fund, though it does include far more volatility. An S&P five hundred index fund is an excellent option for beginning buyers mainly because it offers wide, diversified exposure on the inventory marketplace.

Investments in finances are instruments that investors acquire as a way to know a increased return afterwards. Most often, these devices are stocks.

A money Specialist will offer you advice based on the data presented and provide a no-obligation call to higher fully grasp your predicament.

Although Qualified funds management is dearer than handling revenue by your self, some buyers Really don't thoughts purchasing the advantage of delegating study, financial investment conclusion-producing, and trading to a professional.

With a longer time horizon, you are able to put money into shares and inventory cash and afterwards be capable to maintain them for at least three to 5 years.

Look at our residence acquiring hubGet pre-authorised to get a mortgageHome affordabilityFirst-time homebuyers guideDown paymentHow Substantially am i able to borrow house loan calculatorInspections and appraisalsMortgage lender critiques

That are they great for? When stocks operate up in valuation as they do occasionally, several buyers speculate exactly where they can set their investment decision bucks. Value inventory funds may be a immediate-luminary.app fantastic choice.

Pro tip: A portfolio frequently gets to be much more complex when it has far more investable property. You should response this problem that can help us join you with the appropriate Experienced.

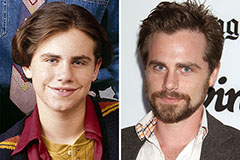

Rider Strong Then & Now!

Rider Strong Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!